ABOUT US

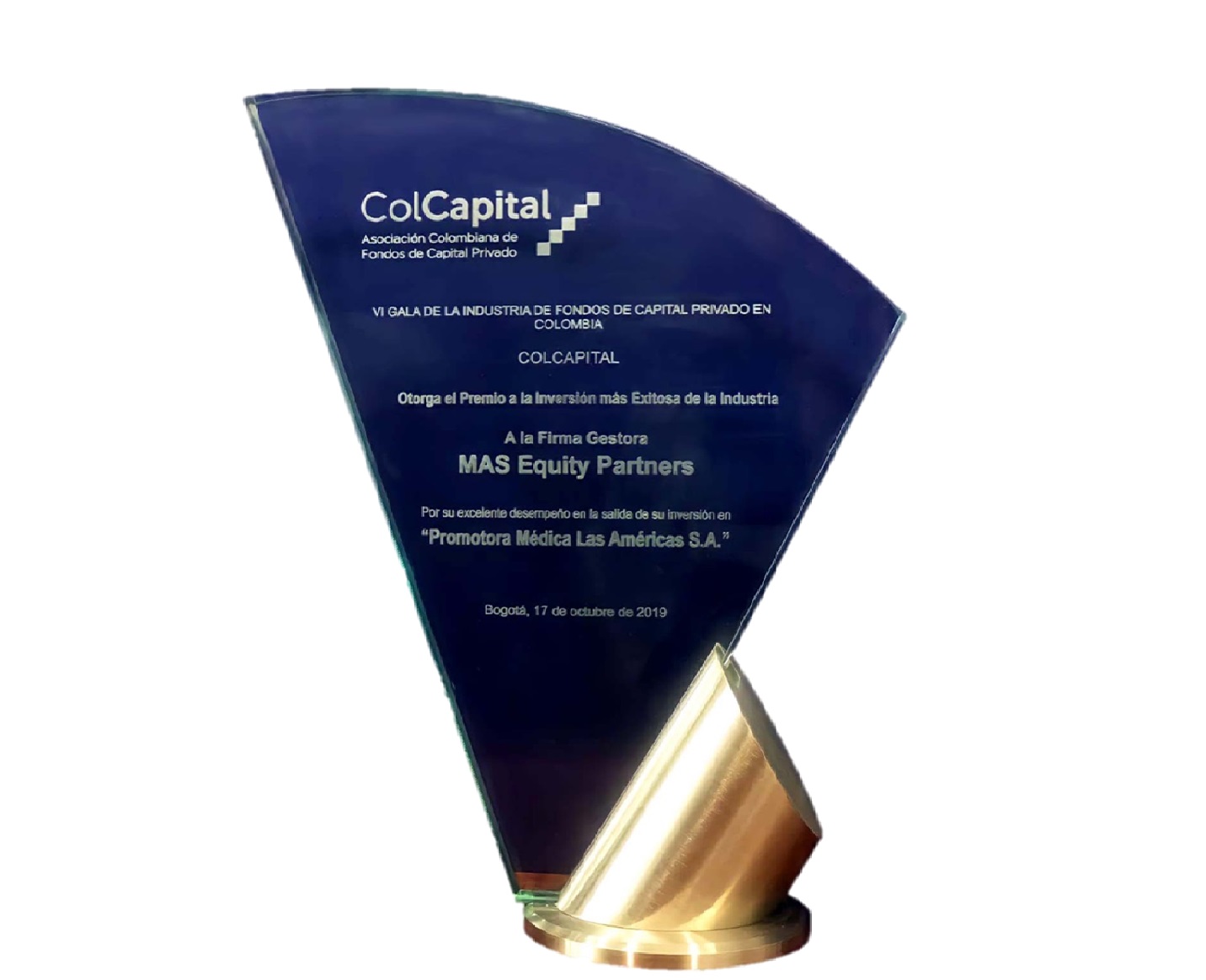

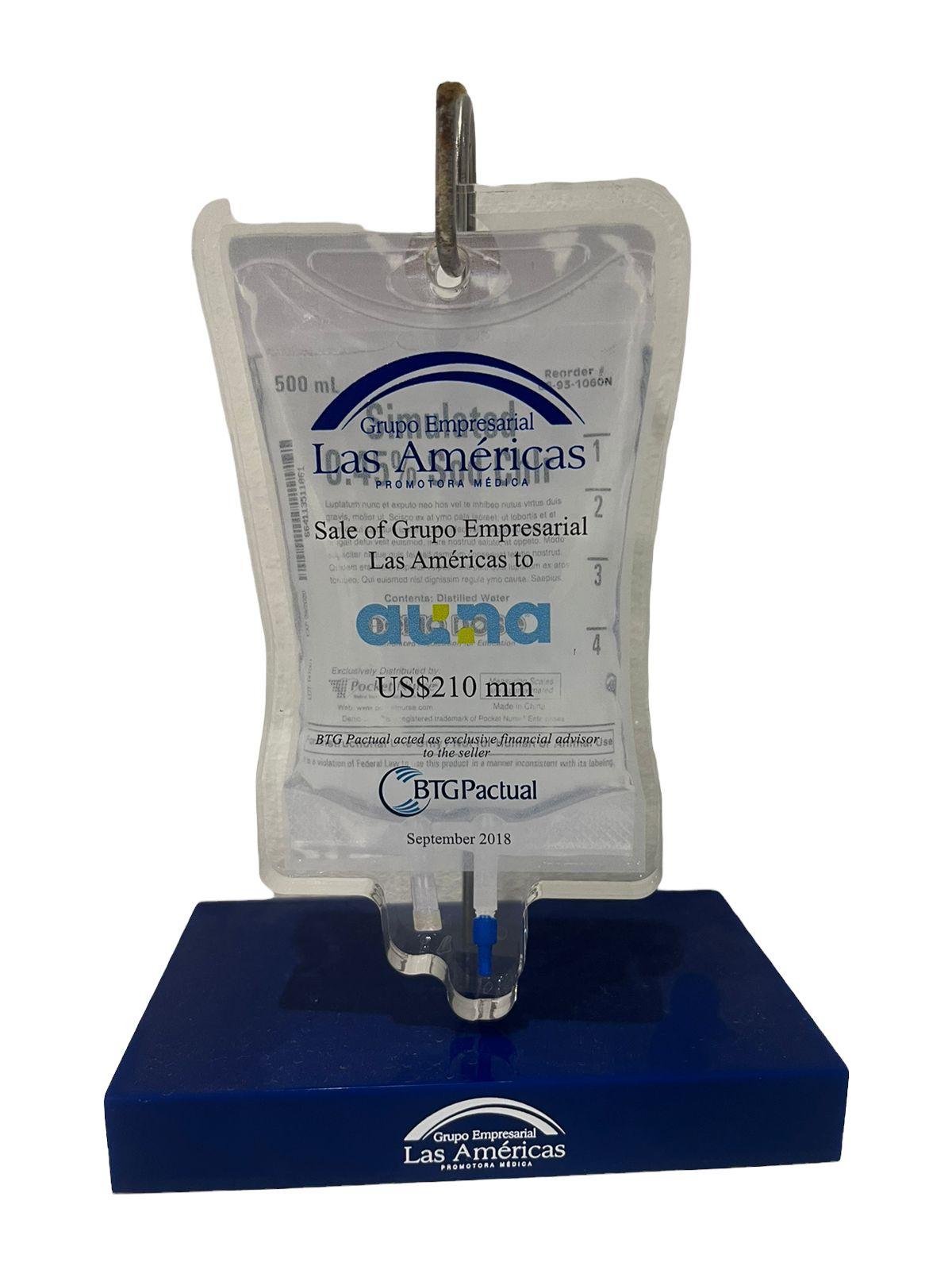

• MAS EQUITY PARTNERS is a pioneer private equity fund manager in the Andean Region, with more than 16 years of successful activity.

Backing VISIONARY ENTREPRENEURS through minority equity investments and effective field support.

• STRATEGIC GUIDANCE based on best practices of corporate governance and management.

• SUSTAINABLE VALUE CREATION through proprietary and proven methodology, "Building Blocks".

• RESPECT, TRANSPARENCY & RECIPROCITY to build win-win long-term partnerships.